Banks are shrinking all over Europe. The consequences are being felt as far away as India and Turkey where project finance is getting scarcer and dearer.

Banks in Europe and Japan are the buyers of last resort for their countries' debt.

In the U.S., there is no housing finance except as provided by the government.

In China, the banks have over-lent and are in danger of becoming insolvent if there is a property downturn and they are forced to mark their assets to market. Therefore the Chinese banks cannot go on being the engine that drives the Chinese development train.

At the same time, those who sell oil to the rest of the world and wealthy individuals the world over are looking for safe havens in which to invest their liquidity, but are finding none. Pension funds and endowments similarly seek safe assets that earn a yield that can permit them to fund their ongoing needs-and they are finding none, either.

What is going on? Whose fault is it? And what are the solutions?

What Is Going On?

The financial world has not gone crazy. It is coming back toward reality.

For several decades, the European, Chinese, Japanese-and even American-governments have effectively guaranteed the debts of their banking institutions. Not surprisingly, such guarantees have enabled the banks to bloat themselves, unchecked by market forces. The governments should have recognized the moral hazards inevitably embedded in their guarantees. Such a recognition would have (or at least should have) led them to impose stricter regulatory capital requirements as a stand-in for the markets.

But the governments did not do that. Instead, they loosened capital requirements through Basel II. And why not? All looked rosy, and practically everyone loved the apparent prosperity that increased lending and higher leverage generated. Of course, the whole thing imploded in 2007-2008, as it was bound to do.

In the wake of the financial crisis brought on by the governments' own willful love of credit markets for everyone, Basel III and Dodd-Frank are tightening the screws on bank capital requirements, which is forcing banks to contract and to evaluate the costs of granting credit more realistically. That process has about two more years to run. (The Europeans may well make the mistake of watering down some of Basel III. That could put their banks at a disadvantage in obtaining funding in the global capital markets. But the French, for example, do not yet believe that.)

At the same time, major corporates are having little difficulty gaining funding in debt and equity markets. Even in Europe, where the banks are contracting most severely, major corporates are funding themselves quite nicely in the capital markets. It is only middle market credits that are finding the loss of bank funding a serious impediment to expansion. And even there, it seems like it is the weak economic environment - including weak consumer demand - that is the big impediment to the growth of medium-sized European businesses. Thus, the long-term shift is continuing from banks as the major lenders to society to credit granted more directly by the market through intermediaries that arrange credit transactions between lenders and borrowers.

Whose Fault Is It?

The process of bank contraction that is going on today is no one's fault. The fault was in encouraging and fostering the bloat and the credit bubble. There is no fault in fixing those problems, painful though the process of remediation may be. We must constantly remind ourselves that the fault is in the boom, not in the bust. The bust is made inevitable by the boom.

What Are The Solutions?

The solutions are to make laws that permit the capital markets to function better and to progressively get governments out of the financing business. Unfortunately, these solutions do not make for good politics. No one ever got elected by enacting laws that make the market work better. And no one ever got elected by restricting credit. Those goals do not even sell newspapers. But they are the solutions that can lead to long-term economic stability and growth.

The Causes of the Great Recession

Many historians of the Great Recession have incorrectly identified the market mechanism (a.k.a. capitalism) as a root cause. The market mechanism has been wrongly discredited, not because it is perfect or because it played no role in creating the boom that led to the bust, but because the fundamental causes of the boom were governmental efforts - successful efforts - to spur economic activity by creating more credit.

The capital market's natural tendency is to create as much credit as it can create profitably. When constrained by the natural equity capital that markets require, that credit-creating propensity is kept in check. The absolute level of credit may not at any time be optimal, but it will tend to self-correct, with relatively modest dislocations either way. But when governments have, seemingly in concert, provided the appearance that assets are riskless and that capital buffers are not necessary, then credit soars, the boom gathers steam, then the bust reverses the process. The assets turn out to have risk, and consumers no longer can fund their buying sprees with borrowed money. Contraction then cannot be prevented.

It appears to me that policy-makers and the public have not understood these lessons of the Great Recession and accompanying financial crisis. Most of the many books on the subject have been counterproductive. A few of them were discussed on SA in the last few days, illustrating my point. The books seek scapegoats and blame the bust rather than the boom. It is more important to journalists to sell their books and to appeal to their natural political constituents than it is to be correct in their analyses.

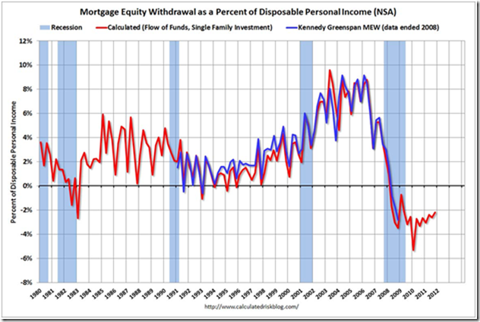

Few people are willing to admit that the bad times were a natural consequence of the good times. Even fewer are willing to admit that natural forces of technology at work in the world are making it difficult for those without world class skills to flourish - or, in many cases, even to get jobs. The excessive credit advanced in the early 2000s masked this reality for a time. See the following graph, courtesy of Calculated Risk:

Click to enlarge

The equity withdrawal allowed consumer spending to continue despite reduced consumer earning power, which made the underlying reality hard to see.

But now that reality is here to stay - at least for a couple of decades - and no governmental policy can make it go away. That reality won't stop the chattering class from wishing it would go away. Here is a quote from Gail Collins, a respected-in some circles-NY Times columnist, on May 3: "Please, let's not get into Charles Murray. I'm in the camp that says there's nothing wrong with America that a big burst of job growth for average people with high school educations wouldn't cure."

Who do you think is going to hire them, Gail? The Sugar Plum Fairy? Or should the government put them all to work doing what, exactly? (This may seem off the main subject of this article, but education, beginning very young, is the only answer to this problem that affects all the high-GDP-per-person countries.)

The tendency of governments to react to low employment by pumping up credit continues to threaten the opportunity to create sustainable economic growth.

The Fed Is Pursuing Sound Regulatory Policies

There are some bright spots in the policy world. These include the Fed's persistence (see May 2 speech by Governor Daniel Tarullo) in pursuing sounder regulatory capital requirements and stress tests, as well as supporting the SEC in its efforts to reform the money market mutual funds. Those efforts should go a long way toward alleviating the possibility that the same mechanisms will create the next boom and bust cycle.

The big problem with TBTF is not the bailout costs. Those were modest. The big problem with TBTF is that it results in excessive credit formation, resulting from the TBTF banks and companies being able to fund themselves at artificially low cost, based on the government's implied backing. While others moan about "credit crunch" and a "lack of loan growth," I am cheering the deleveraging of the global economy.

Interventionist Fiscal and Monetary Policies

But sadly, the age of government fiscal and monetary financial manipulation seems far from over. If we look back at the last (basically first) hundred years of central banking, we can see that in each decade the central banks of the western world and Japan have been trying to undo the mistakes they (and their fiscal counterparts) made in the previous decade or two.

Martin Wolf, the FT's chief economist, wrote on May 1:

"What is the future of central banks? It will be busy, because they are now expected to deliver both monetary and financial stability. It will be controversial, because the decisions they make have a huge impact on the distribution of income, people's access to finance, the way the financial system operates and even the solvency of governments.

"Then, if they manage the exit successfully, which we will probably not know until the 2020s, central banks will confront a new world. They will need to balance their old roles as formulators of monetary policy with new roles as guardians of financial stability. Making this still harder will be the dire fiscal legacy of the crisis. The higher levels of public sector debt threaten a return to 'fiscal dominance' in which central banks will, willy nilly, be forced to finance the government, however inappropriate that may be."

Mr. Wolf is better tuned to central-bank-speak than just about anyone else that I read, so I am inclined to assume he is correct about the continued active intervention in which central banks are likely to engage. Thus we should assume that central bank yeeing a yawing will be a continuing feature of the financial landscape that will depress the potential for global economic growth. That is too bad, but it still will not prevent some improvements. (The ECB may be alone among central banks that might steer a less activist course. The ECB's current activism is reluctantly - though properly - taken. Therefore Europe might, if it can figure out appropriate structural reforms for the eurozone, be the best place to look for stability and steady growth a decade from now.)

The attraction of credit to policy makers is that it has no apparent cost. The cost only appears down the road, on somebody else's watch, when the loans cannot be re-paid. Then the policy makers seek to monetize or socialize the costs of their mistakes, which leads to the next round of problems. Most of the western world now is in the throes of that next round of problems.

The Costs of Credit and Their Impact

Despite continued governmental financial activism, so long as sound capital requirements are enforced, the costs of many kinds of credit will go up, But the cost of credit will go up less than advocates of governmental credit-granting might think. I do not have a model that could estimate the increase, but I would guess that the increase will be much less than 100 basis points for almost all kinds of credit.

If that 100 basis points redounds to the benefit of savers across the globe, the net effect even could be positive.

In this context, we should bear in mind that recent studies suggest that job growth is spurred most by new firms. New firms are not generally financed by bank loans or other forms of credit from the organized credit markets to the new businesses. New businesses are funded by their founders (sometimes with money borrowed against their homes) and their founders' friends, with venture capital sometimes playing a significant role as well.

Project Finance

The cost of project finance will go up, including the cost of providing additional equity. But the overall cost of the project will, I believe, go down, because projects that are built because the funding is available are far less efficient than projects that are built because they are needed and therefore someone puts up the equity money.

Trade Finance

There is always money for trade finance in a world where banks can trust each others' balance sheets, as they will be able to do if sound regulatory capital requirements are enforced globally. Trade can stand a few more basis points of cost if financing is readily available to creditworthy buyers and sellers.

Mortgage Finance

In the U.S., home mortgages have been lousy products for investors for over 50 years. That is why the U.S. government now is the only market participant. To reiterate what I have written before: The government supported the S&Ls and encouraged them to make long-term mortgages. The long-term mortgages killed the S&Ls, at great government expense. The government set up Fannie (FNMA.OB) and Freddie (FMCC.OB) and required them not only to make long-term mortgages, but also to compromise their lending standards to serve lower-income borrowers. In due course, Fannie and Freddie failed, at great government expense. The government set up the FHA to make loans to lower-income borrowers, and that, too will fail at great government expense.

All this governmental intervention began because policy makers wanted home owners to have the stability of fixed-rate long-term mortgages, forgetting that no institution could fund such mortgages properly. (The homebuilders of course did everything they could to encourage this policy, since it helped to sell new homes.) Then the policy makers saw that it would be neat to give the borrowers the option to refinance if the market went against them, so they required that, which, naturally, made the long-term mortgage almost impossible to hedge. That is how we got to where the government is the only lender left, operating through Fannie, Freddie, the FHA and the agency business of the loan originators.

Getting out of that policy box is going to be very difficult. It will not take place for a long time. Too many people like their fixed rate, long-term mortgages with the option to refinance whenever it is profitable to do so. Plus, there are now all those originators that benefit from the refi business, construction is in the tank and needs to be encouraged, etc. The politics are very hard to overcome.

If I were philosopher king, I would fix the securitization market, remove the option to refinance, and get the government out of the business. Costs would go up, but not as much as people think. The main thing would be that down payments would be 20-25%, as they used to be in the "stable, good old days." That is not likely to happen. Therefore the U.S. government is likely to remain the housing lender of last resort for a long time. The big banks are not daft enough to make these loans for portfolio. That was never their business; and it should not be.

I do not know enough about mortgage finance outside the U.S. to guess about who will make the loans in the future. Perhaps the politics are better elsewhere.

Business Lending

Almost everyone wrings their collective hands about how banks shrinking will affect businesses as borrowers. Frankly, this is a very minor worry because business loan volumes depend mostly on demand, not on supply. Good business loans are the heart of most banks' profitability. If we look, for example, at large European banks' loan volumes, we find that their deposits exceed their business loans by a considerable amount. The banks make other, less profitable or more risky loans because business loans are not available in sufficient volume. I have seen no evidence that loans to creditworthy businesses go unfunded. Unfunded business loan demand might have become a problem in the harshest part of the European bank contraction phase had the ECB not provided liquidity. But longer term, a smaller European banking system can fund business loan demand quite adequately.

(There are structural problems in some countries where family-owned businesses are secretive vis-vis their banks, and banks that adopt sound underwriting standards deny the credits for lack of information. Such structural problems - that are caused by capital flight and tax evasion - have to be dealt with by deterring capital flight and tax evasion, not by changing lending policies.)

The New Lenders

BlackRock (BLK) is the flagship new lender. With about $3.7 trillion of assets under management and virtually no debt, BlackRock is an unleveraged lender that takes a cold, hard look at all asset classes. It is as large as the largest banks, makes more loans than the largest banks, and is about 1/100th as dangerous as the soundest large bank. BlackRock has enormous power to advance large amounts of credit to whatever parts of the world can use it best.

Other money managers like PIMCO, Vanguard, Fidelity, etc. have much the same, though smaller, capacity. By building up and focusing on its private wealth business, UBS (UBS) is putting itself in a similar position. On a smaller and riskier scale, Blackstone (BX) and Apollo (e.g., through AINV) are positioning themselves as lenders as well as private equity companies.

Sovereign wealth funds and other new vehicles being formed throughout flourishing Asia are gaining both capacity and expertise.

Although these or other new lenders will supply credit, they are not likely to significantly undercut the pricing of the traditional banks. Although many of the banks complain bitterly that the modern regulatory capital requirements are unduly harsh, it will become clear that lenders that depend on markets for their discipline must hold at least as much capital as the old banks are required to hold by regulation. This situation is demonstrating - and will continue to demonstrate - that the lax capital regime of the 2000s was a significant factor in encouraging the overlending of that period.

Money market mutual funds, one of the unwitting engines of the boom and bust, will be a smaller factor in global capital flows, since-probably by the end of 2013 they will no longer have the benefit of fictitious one-dollar pricing. That will lead to a greater variety of short-term investment vehicles, both open-end and closed end, each more attuned to a specific risk profile. These vehicles will provide a variety of types of long and short-term funding to corporates and governmental projects. The money market fund will have turned out to be a dumb catch-all that served the global financial system badly.

Who Will Flourish?

Curiously, unless the governments screw it up even worse than I think they will, almost everyone can flourish. There is plenty of liquidity in the world. Its problem is that with governments keeping interest rates artificially low, the liquidity has to go up the risk scale in order to earn a return; hence the boom in junk bond issuance. That will cause losses to some investors, but probably not the most leveraged ones, so the losses will fall where they should fall rather than being socialized.

Banks - even in Europe - should be able to fund themselves because their capital will be perceived as sufficient. One should recognize that bank liquidity depends on the amount and quality of the bank's capital, not on how fast it can sell its assets. Good capital leads to market confidence. Weak capital leads to a lack of market confidence at times of stress. Liquidity requirements are, in my opinion, a chimera.

Once the excess credit has been wrung out of the system, which will take another two to three years, there is a chance for some sustained, slow global growth. Global liquidity is high and is likely to remain high. Banks have large amounts of "excess reserves" parked at their central banks, inflows to all kinds of money managers continue to be strong. Good credits will have no difficulty in finding funding. The greatest risk is that governments will once again encourage or require institutions to lend to people or businesses that are not good credits. Such governmental actions would tend to spur a boom not unlike the boom of the mid-2000s, with similar likely consequences for a bust, though probably of lesser proportions.

From a credit risk point of view, U.S. government securities will continue to be safe, as will the securities of other governments that borrow in currencies that they have the right to print, including the U.K. The future creditworthiness of European governments remains a significant medium-term risk, however, in view of their inability to print their way to repayment. Sensible Europeans will, therefore, have to diversify their currency risks, as they have done for a long time.

I see that I mentioned China in the first few paragraphs of this article, then seem to have forgotten about it. That is not because I doubt that China will be an important source of external finance. With its enormous cache of foreign currency, China must be a lender to the rest of the world on a large scale, though probably not through its banks. Whether Chinese banks can restore their capital positions, I do not know. Their financial condition is sufficiently opaque that even this intrepid commentator will not venture a guess.

I also see that I leave myself open to the charge that I am an unrepentant, elitist free market capitalist who is uncaring about the poor and middle classes.

- First, I believe that markets require regulation and that it is competitive markets, not free markets, that we need.

- Second, governments should undertake some projects. But they should be needed projects, not projects undertaken to provide employment.

- Third, meritocracy is what we have and will have. In that sense, I am an elitist. The question is whether we will use our governmental resources to educate everyone as well as possible, not only those that are born to privilege like my grandchildren. If we want greater equality of opportunity - and I do - then we must educate everyone, and we must pay for it with taxes collected from those who have the capacity to pay taxes.

- Fourth, palliatives for the poor are, unfortunately, needed, and they must be paid for by the rest of us. But in providing those palliatives, we have to worry about the moral hazard issues. That makes the subject perhaps the most difficult in the entire field of public policy.

- My brief is not to withdraw support for the poor and near-poor but to provide support that is direct and has known costs, not support that, like loans, appears to have no cost but ends up with substantial costs.

I also believe that governments could pay for much of the needs of education and the poor by cutting the costs of various programs that are designed to subsidize various well-placed industries-otherwise known as "pork."

Finance is overrated. Education is not.

Disclosure: I am long BX.

2013 toyota avalon the secret life of bees full moon amber rose aubrey o day masters live johan santana

কোন মন্তব্য নেই:

একটি মন্তব্য পোস্ট করুন